Dear Vishi, daily log on March 10, 2023.

Dear Vishi, this is my daily log for March 10, 2023.

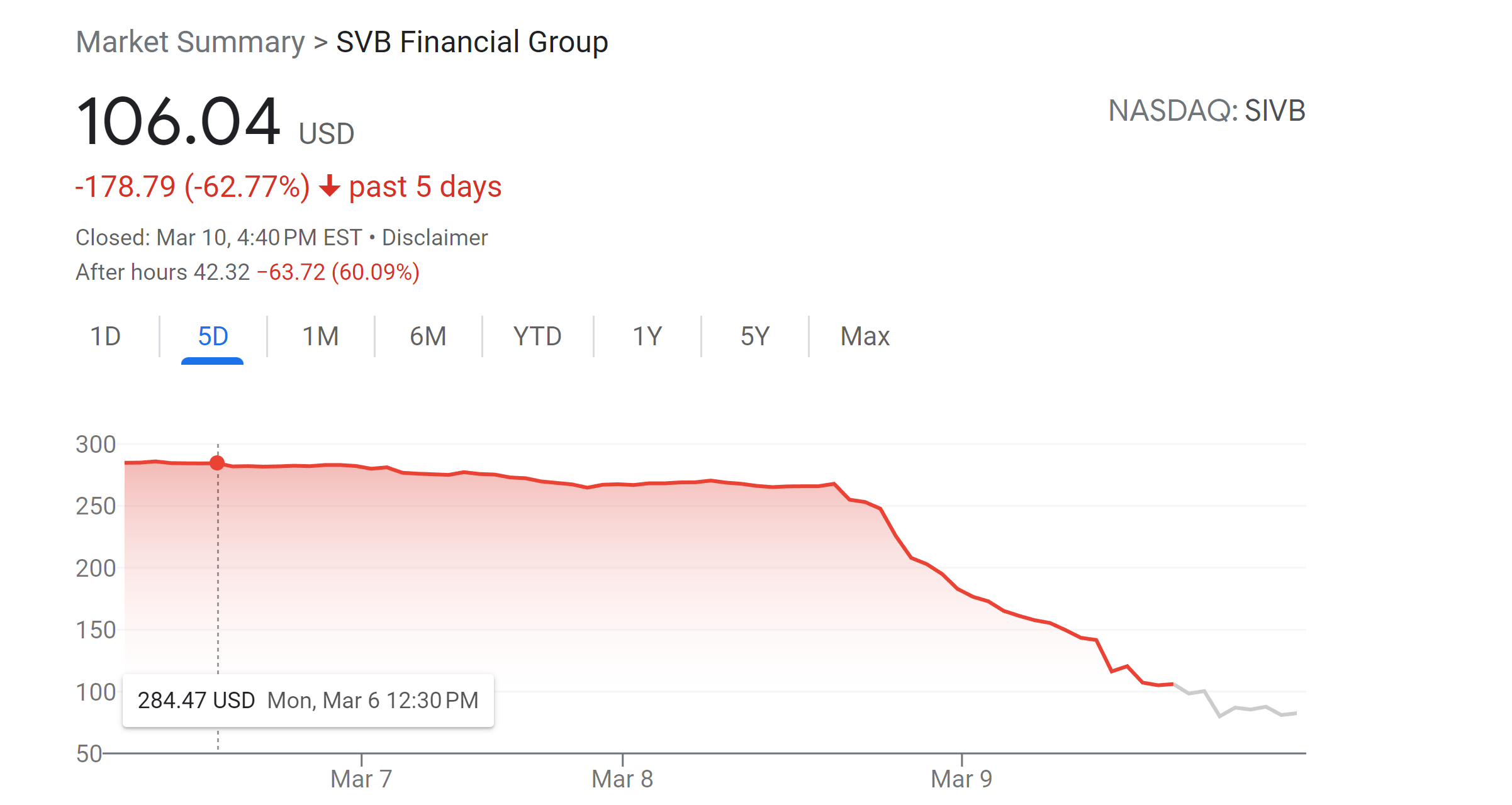

My Twitter feed is being inundated with news regarding the collapse of Silicon Valley Bank. The stock price of $SIVB has plummeted from $300 to $80 in just a few days. This piqued my curiosity, so I dug a little deeper to understand what the fuss is about.

|

Silicon Valley Bank is known for specializing in providing financial services and resources to early-stage and high-growth technology companies and venture capitalists. However, recent reports suggest that the bank may be facing financial challenges due to its investment strategies.

It was reported that the bank invested its customers' money in mortgage-backed securities (MBS), which yield between 1.56-1.66%. However, the Federal Reserve interest rate is currently at 4.57%, which has caused concerns among depositors.

A bank run is a situation where a large number of depositors withdraw their funds from a bank at the same time, usually due to concerns about the bank's solvency or ability to meet its obligations. Silicon Valley Bank experienced a bank run because it had mostly uninsured deposits from startups who borrowed money from the same bank, leaving it vulnerable to a run.

The collapse of Silicon Valley Bank was reportedly due to depositors, mostly technology workers and venture capital-backed companies, pulling their money out, resulting in the bank's insolvency.

comments powered by Disqus