life is too short for a diary

Weekly Logs from Jan 22 to Jan 28, 2024

Snapshot of my habits

| Activity | Streak | Count | Logging |

|---|

Buying a stock

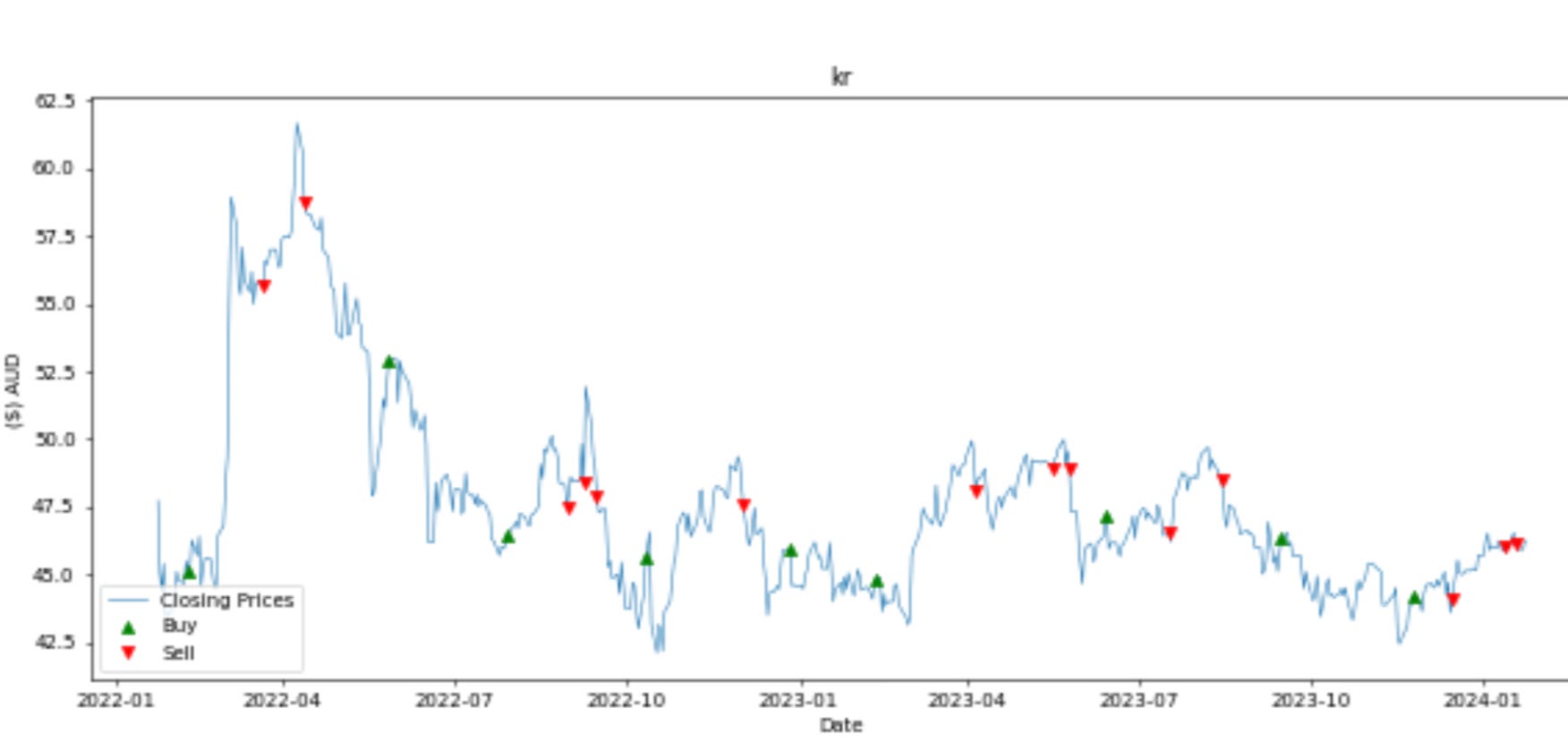

kr stock

Here's a moving average:

|

Lets look at some metrics

| Dividend | 2.51% |

| RSI(14) | 57.20 |

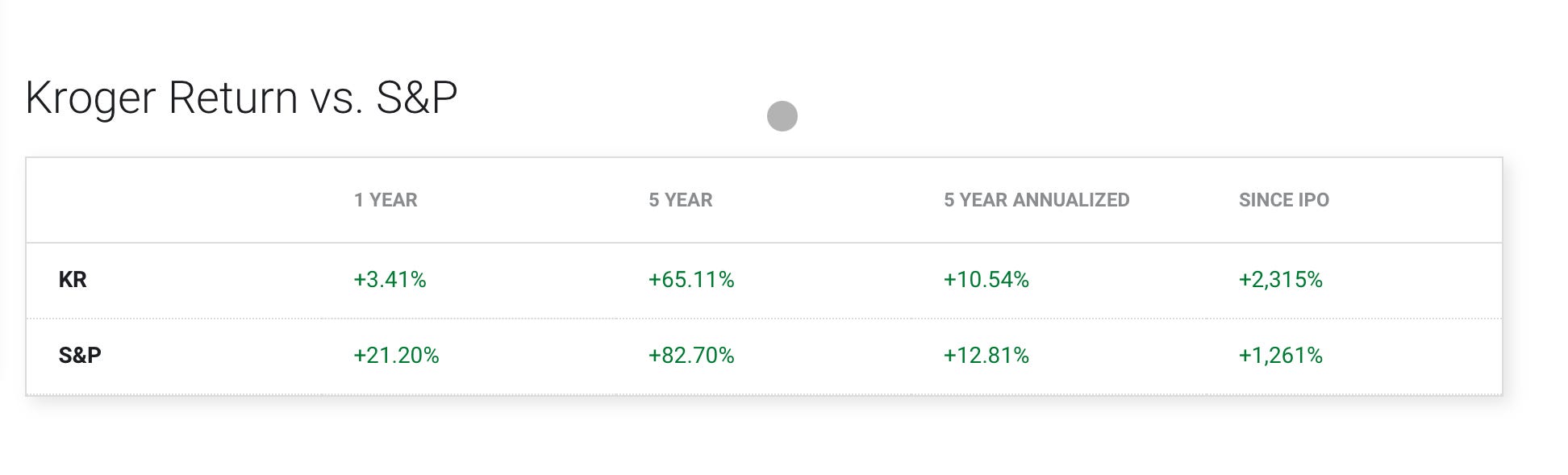

Lets compare it with S&P

|

Why not just invest in VOO then if it doesn't give more return than S&P?

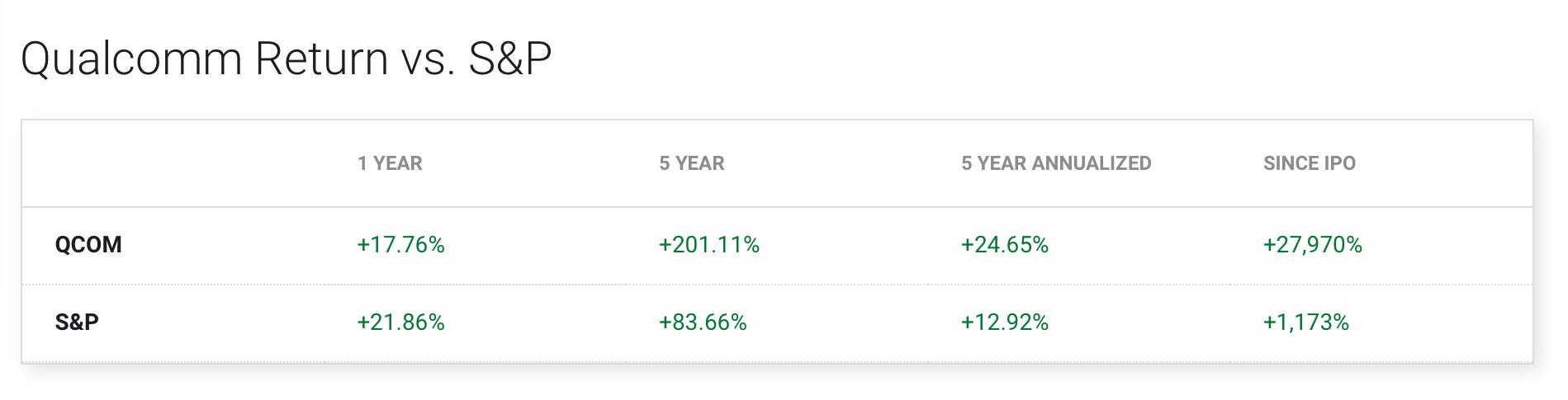

qcom stock

First lets compare against it S&P

|

Lets look at some metrics

| Dividend | 2.12% | |

| RSI(14) | 64.54 | |

| EPS | 1.98 (12/25/2022) | |

| PEG | 2.15 | Stock is relatively high compared to its earning growth rate |

How about moving average?

|

comments powered by Disqus